Achieve financial freedom faster by mastering innovative tool Mortgage Payoff Calculator .This calculator helps you make informed decisions about your mortgage and loans, demonstrating the benefits of early payoff, interest savings, and loan term reduction, ultimately guiding you towards a debt-free future.Loan Payoff Calculator Early will help to pay your loan early.

Mortgage Payoff Calculator

[ez-toc]

What is a mortgage?

In simple terms, a mortgage is a loan that is used to buy a property. It’s a way for people to finance the purchase of a home without having to pay for it all upfront. Instead, the borrower (that’s you) borrows money from a lender (usually a bank or other financial institution), and then pays that money back over a set period of time, along with interest.

Mortgages can be complicated, with a lot of different terms and concepts to understand. But don’t worry – we’ll break it down for you step by step.

How does a mortgage work?

When you apply for a mortgage, you’ll be asked to provide information about your income, assets, and debts. The lender will use this information to determine how much money they are willing to lend you. This is called the “loan amount.”

Once you have been approved for a mortgage, you’ll receive a document called a “mortgage agreement.” This document outlines the terms of the loan, including the interest rate, the length of the loan, and the monthly payment amount.

The interest rate is the amount of money you’ll be charged for borrowing the money. It’s expressed as a percentage of the total loan amount. The interest rate can vary depending on a number of factors, including your credit score, the size of your down payment, and the current state of the economy.

The length of the loan is the amount of time you’ll have to pay back the money. Mortgages typically have a term of 15, 20, or 30 years, although other terms are also available.

The monthly payment amount is the amount you’ll need to pay each month to repay the loan. This amount includes both the principal (the amount you borrowed) and the interest.

What is a down payment?

When you buy a house, you’ll typically be required to make a down payment. This is a percentage of the total purchase price of the home that you’ll need to pay upfront.It is typically between 3% and 20% of the purchase price, although it can vary depending on the lender and the type of loan.

The larger your down payment, the less you’ll need to borrow, and the lower your monthly payment will be. However, saving up for a down payment can be difficult, especially if you’re a first-time homebuyer. There are some programs available to help you with your down payment, so be sure to do your research.

What is a mortgage payment?

Your mortgage payment is made up of four main components: principal, interest, taxes, and insurance. Let’s break each one down:

Principal: This is the amount you borrowed to buy the house. Each month, a portion of your mortgage payment goes toward paying off the principal.

Interest: This is the amount you’re charged for borrowing the money. It’s based on the interest rate and the amount you borrowed.

Taxes: Property taxes are assessed by your local government and are based on the value of your home. They can vary depending on where you live.

Insurance: Homeowners insurance is required by most lenders to protect the home in case of damage or loss.

All of these components are added up to determine your monthly mortgage payment.

Why do people get mortgages?

People get mortgages for a variety of reasons. For most people, buying a home is the biggest investment they’ll ever make. Mortgages allow them to finance that investment over time, rather than paying for it all at once.

Principal and Interest of a Mortgage

If you’re in the market to buy a home, then you’ll likely come across the terms “principal” and “interest” when applying for a mortgage. Understanding what these terms mean is essential to making informed decisions about your finances. In this article, we’ll break down what principal and interest are and how they relate to your mortgage.

What is Principal?

The principal is the amount of money that you borrow to purchase your home. It’s the total amount that you will need to pay back to your lender over the life of your loan. For example, if you take out a $300,000 mortgage to buy a home, then your principal is $300,000.

Each month, a portion of your mortgage payment will go towards paying down the principal. As you make these payments, the amount of principal you owe will decrease. By the end of your mortgage term, you’ll have paid back the entire principal amount, plus interest.

What is Interest?

Interest is the cost of borrowing money from your lender. It’s calculated as a percentage of the outstanding principal amount of your mortgage. The interest rate on your mortgage will depend on a variety of factors, including your credit score, the size of your down payment, and the current state of the economy.

Interest is paid in addition to the principal amount, so the total cost of your mortgage will be the sum of the principal and the interest. For example, if you take out a $300,000 mortgage with a 4% interest rate, you’ll pay a total of $12,000 in interest each year.

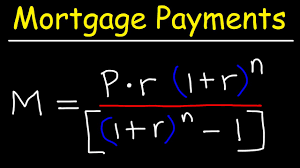

How is Principal and Interest Calculated?

When you apply for a mortgage, your lender will provide you with a document called an amortization schedule. This schedule outlines the breakdown of your monthly mortgage payment, including how much of your payment will go towards the principal and how much will go towards interest.

In the early years of your mortgage, a larger portion of your monthly payment will go towards paying interest. This is because the outstanding principal amount is higher, and interest is calculated as a percentage of the principal. As you make more payments and the outstanding principal amount decreases, a larger portion of your monthly payment will go towards paying down the principal.

Benefits of Paying Down Your Principal

Paying down your principal can have several benefits. First, it can help you build equity in your home. Equity is the difference between the market value of your home and the outstanding principal amount of your mortgage. As you pay down your principal, your equity will increase.

Paying down your principal can also help you save money in the long run. The less principal you owe, the less interest you’ll have to pay over the life of your loan. Additionally, paying down your principal can help you pay off your mortgage faster, which can help you save even more money on interest.

In conclusion, understanding the concepts of principal and interest is essential to making informed decisions about your mortgage. By understanding how your mortgage payment is calculated, you can make a plan to pay down your principal and save money over the life of your loan.

Extra Payments,repayment Weekly/Biweekly/Monthly Payments

If you’re a homeowner with a mortgage, you may be wondering about the benefits of making extra payments, or adjusting your repayment schedule. In this article, we’ll break down the advantages of making extra payments and adjusting your repayment schedule to pay off your mortgage faster and save money.

Extra Payments

Making extra payments on your mortgage means paying more than the required monthly payment. By doing so, you can reduce the amount of interest you pay over the life of your loan and pay off your mortgage faster.

There are several ways to make extra payments:

One-time lump sum payment: You can make a one-time lump sum payment towards your principal balance.

Annual payments: You can make an annual extra payment.

Monthly payments: You can add a set amount to your monthly payment, which will go directly towards your principal balance.

By making extra payments, you can reduce the amount of interest you pay over the life of your loan and pay off your mortgage faster. This can help you save thousands of dollars in interest payments and shorten the length of your mortgage term.

Repayment Schedule

Another way to pay off your mortgage faster is by adjusting your repayment schedule. You can do this by switching from a monthly repayment schedule to a weekly or biweekly repayment schedule.

By making weekly or biweekly payments, you are effectively making an extra payment each year. This is because there are 52 weeks in a year, which means you’ll make 26 biweekly payments (or 52 weekly payments), which is equivalent to 13 monthly payments.

This can result in significant savings over the life of your loan. For example, if you have a $300,000 mortgage with a 30-year term and a 4% interest rate, you could save over $34,000 in interest payments by switching from a monthly to a biweekly repayment schedule.

However, it’s important to note that not all lenders allow for biweekly payments. Make sure to check with your lender before making any changes to your repayment schedule.

Advantages of Making Extra Payments and Adjusting Your Repayment Schedule

Save money: Making extra payments and adjusting your repayment schedule can save you thousands of dollars in interest payments over the life of your loan.

Pay off your mortgage faster: By making extra payments and adjusting your repayment schedule, you can pay off your mortgage faster, which can help you achieve financial freedom sooner.

Build equity in your home: By paying down your principal balance faster, you can build equity in your home, which can be beneficial if you plan to sell your home in the future.

In conclusion, making extra payments and adjusting your repayment schedule can be a smart financial move for homeowners with a mortgage. By doing so, you can save money, pay off your mortgage faster, and build equity in your home.

Should I Pay Off My Mortgage Early?

We’ll explore the pros and cons of paying off a mortgage early to help you make an informed decision.

Pros of Paying Off Your Mortgage Early

Save Money on Interest: Paying off your mortgage early can save you thousands of dollars in interest payments over the life of the loan. This can free up money for other financial goals, such as retirement savings or paying off other debts.

Peace of Mind: Paying off your mortgage early can give you a sense of financial security and peace of mind, knowing that you fully own your home and are no longer in debt.

Increase Equity: By paying off your mortgage early, you can increase the equity in your home. This can be beneficial if you plan to sell your home in the future, as you’ll receive more money from the sale.

Reduced Risk: Paying off your mortgage early can also reduce your financial risk. If you experience a job loss or other financial hardship, having a paid-off mortgage can provide a safety net and reduce financial stress.

Cons of Paying Off Your Mortgage Early

Opportunity Cost: If you use all of your savings to pay off your mortgage early, you may miss out on other investment opportunities that could provide a higher return on investment. For example, if you have a low-interest mortgage, investing your money in a higher yielding investment vehicle, such as stocks or mutual funds, may provide a better return.

Lost Tax Benefits: Mortgage interest payments are tax-deductible, which can reduce your overall tax bill. If you pay off your mortgage early, you’ll no longer be able to take advantage of this tax benefit.

Illiquid Asset: Real estate is a relatively illiquid asset, which means that it can be difficult to access the equity in your home if you need cash for other purposes. If you pay off your mortgage early, you may be tying up a significant portion of your wealth in a single asset.

Missed Opportunity for Diversification: By paying off your mortgage early, you may be missing out on the opportunity to diversify your portfolio by investing in other assets, such as stocks, bonds, or real estate.

- Refinance Your Mortgage

Refinancing your mortgage can be a smart way to pay off your mortgage early. By refinancing to a lower interest rate, you can save money on interest payments and pay off your mortgage faster. Additionally, you can consider refinancing to a shorter loan term, such as a 15-year mortgage. While your monthly payment may be higher, you’ll pay off your mortgage faster and save money on interest payments over the life of the loan.

- Make Lump Sum Payments

Making a lump sum payment towards your mortgage can help you pay off your mortgage faster. If you receive a bonus at work or have extra savings, consider putting that money towards your mortgage. Even a one-time payment can significantly reduce the amount of interest you pay over the life of the loan and help you pay off your mortgage faster.

- Cut Your Expenses

Cutting your expenses can free up extra cash that you can put towards your mortgage. Consider cutting back on discretionary spending, such as eating out or buying new clothes. You can also look for ways to reduce your monthly bills, such as by cutting cable or negotiating lower insurance rates. By reducing your expenses, you can put more money towards your mortgage and pay it off faster.

- Rent Out a Portion of Your Home

If you have extra space in your home, consider renting it out to generate extra income. You can rent out a spare bedroom or even a portion of your garage. The extra income can be put towards your mortgage, helping you pay it off faster.

- Make Biweekly Payments

Making biweekly payments can help you pay off your mortgage faster. By making half your mortgage payment every two weeks, you’ll effectively make 13 full mortgage payments each year instead of 12. This can help you pay off your mortgage faster and save money on interest payments.

- Make Use of Found Money

Found money, such as tax refunds or inheritances, can be put towards your mortgage to help you pay it off faster. Rather than using that money for discretionary spending, put it towards your mortgage to reduce the amount of interest you pay over the life of the loan.

In conclusion, there are many ways to pay off your mortgage early. Whether you refinance your mortgage, make lump sum payments, cut your expenses, rent out a portion of your home, make biweekly payments, or make use of found money, every little bit can help you pay off your mortgage faster and save money on interest payments.

Refinance to a shorter termRefinancing your mortgage can be a smart financial move, especially if you want to pay off your mortgage faster. One strategy to consider is refinancing to a shorter loan term. In this article, we’ll explore the benefits of refinancing to a shorter term and what you need to know before making the switch.

What is Refinancing to a Shorter Term?Refinancing to a shorter term means replacing your current mortgage with a new mortgage that has a shorter loan term. For example, if you currently have a 30-year mortgage, you could refinance to a 15-year mortgage.

By refinancing to a shorter term, you’ll pay off your mortgage faster and save money on interest payments over the life of the loan. However, your monthly payments may be higher since you’ll be paying off the loan in a shorter amount of time.

Benefits of Refinancing to a Shorter Term

Save Money on Interest: By refinancing to a shorter term, you can save thousands of dollars in interest payments over the life of the loan. This is because you’ll be paying off the loan in a shorter amount of time, which means less time for interest to accrue.

Build Equity Faster: Refinancing to a shorter term can also help you build equity in your home faster. This can be beneficial if you plan to sell your home in the future, as you’ll receive more money from the sale.

Pay Off Your Mortgage Faster: By refinancing to a shorter term, you’ll pay off your mortgage faster. This can provide a sense of financial security and help you achieve financial freedom sooner.

Get a Lower Interest Rate: Refinancing to a shorter term can also result in a lower interest rate, which can save you money on interest payments over the life of the loan.

What You Need to Know Before Refinancing to a Shorter Term

Higher Monthly Payments: Refinancing to a shorter term will result in higher monthly payments since you’ll be paying off the loan in a shorter amount of time. Make sure to factor in the increased monthly payments when deciding if refinancing to a shorter term is right for you.

Closing Costs: Refinancing to a shorter term will also result in closing costs, which can be several thousand dollars. Make sure to factor in the closing costs when deciding if refinancing to a shorter term is right for you.

Credit Score: Refinancing to a shorter term may require a higher credit score since you’ll be taking on a larger monthly payment. Make sure to check your credit score before applying for a new mortgage.

Prepayment Penalty: Some lenders may charge a prepayment penalty if you pay off your mortgage early. Make sure to check with your lender before refinancing to a shorter term.

In conclusion, refinancing to a shorter term can be a smart financial move if you want to pay off your mortgage faster and save money on interest payments over the life of the loan. However, it’s important to consider the higher monthly payments, closing costs, credit score requirements, and prepayment penalties before making the switch. Talk to a financial advisor or mortgage professional to determine if refinancing to a shorter term is right for you.

Prepayment PenaltiesWhen it comes to paying off a mortgage, you might assume that the earlier you pay off your mortgage, the better. However, some mortgages come with prepayment penalties that can make paying off your mortgage early more expensive. In this article, we’ll explore what prepayment penalties are, how they work, and how to avoid them.

What are Prepayment Penalties?

A prepayment penalty is a fee that lenders may charge borrowers for paying off their mortgage early. The penalty is typically a percentage of the remaining balance of the loan or a certain number of months of interest payments.

Prepayment penalties are designed to protect lenders from losing out on the interest payments they would have received if the borrower had kept the loan for the full term. Prepayment penalties are most commonly found in fixed-rate mortgages and are less common in adjustable-rate mortgages.

How Do Prepayment Penalties Work?

Prepayment penalties are typically triggered when borrowers pay off their mortgage early, refinance their mortgage, or make extra payments beyond a certain amount. The penalty amount can vary depending on the terms of the mortgage and the lender.

For example, a lender may charge a prepayment penalty equal to 2% of the outstanding balance if the borrower pays off the mortgage within the first three years of the loan term. Alternatively, a lender may charge a penalty equal to six months of interest payments.

It’s important to note that not all mortgages come with prepayment penalties, and the terms of the penalty can vary between lenders. Make sure to read the fine print in your mortgage contract to determine if a prepayment penalty applies to your loan.

How to Avoid Prepayment Penalties

Read Your Mortgage Contract: Before signing a mortgage contract, make sure to read the terms carefully to determine if a prepayment penalty applies to your loan.

Negotiate with Your Lender: If you want to avoid a prepayment penalty, consider negotiating with your lender to remove the penalty from your loan.

Refinance Your Mortgage: If your current mortgage has a prepayment penalty and you want to pay off your mortgage early, consider refinancing your mortgage to a new loan without a prepayment penalty.

Make Extra Payments within the Limit: If your mortgage has a prepayment penalty, make sure to stay within the limit of extra payments allowed. For example, if your mortgage allows for up to $10,000 in extra payments per year without a penalty, make sure not to exceed that amount.

Opportunity cost is an important concept in economics that refers to the potential benefits that you miss out on when you choose one option over another. In other words, opportunity cost is the value of the next best alternative that you give up when making a decision. In this article, we’ll explore the concept of opportunity cost, how it works, and provide some examples.

What is Opportunity Cost?

Opportunity cost is the cost of any activity measured in terms of the best alternative forgone. It’s the cost of the next best alternative that you give up when making a decision. For example, if you have $100 and you choose to spend it on a night out with friends, the opportunity cost is the potential benefits you would have received if you had chosen to save or invest the money instead.

How Does Opportunity Cost Work?

Opportunity cost is an important concept in decision-making because it helps you to evaluate the benefits and costs of different options. It involves weighing the potential benefits of each alternative against the potential costs of choosing one over the other.

For example, imagine you have a job offer that pays $50,000 per year, but you also have an offer for a different job that pays $45,000 per year with more flexible working hours. The opportunity cost of accepting the higher-paying job is the potential benefits of having more free time and a better work-life balance.

Examples of Opportunity Cost

Education: The opportunity cost of attending college is the potential income you could have earned if you had entered the workforce immediately after high school. If you spend four years in college and forego $40,000 in income each year, the opportunity cost of attending college is $160,000.

Business Investment: If you have $10,000 to invest in a business, but you choose to invest it in stocks instead, the opportunity cost is the potential benefits you could have received if you had invested in the business instead.

Home Ownership: The opportunity cost of owning a home is the potential benefits of renting instead, such as having more flexibility to move or not being responsible for maintenance and repairs.

Travel: The opportunity cost of traveling for six months is the potential benefits of staying at home and saving money or using that time to invest in your career.

Buying vs. Renting: The opportunity cost of buying a home is the potential benefits of renting instead, such as having more flexibility to move or not being responsible for maintenance and repairs.

In conclusion, opportunity cost is an important concept in decision-making that can help you evaluate the benefits and costs of different options. By considering the opportunity cost of each alternative, you can make more informed decisions and choose the option that provides the most value.

Paying off your mortgage and loans early can be a significant step towards achieving financial freedom. To help you navigate this process and make informed decisions, tools like the Mortgage Payoff Calculator and Loan Payoff Calculator Early are invaluable. In this SEO-friendly article, we’ll explore the usage and benefits of these calculators and how they can assist you in reaching your financial goals faster.

Mortgage Payoff Calculator

A Mortgage Payoff Calculator is a powerful tool that allows you to determine the impact of making extra payments towards your mortgage principal. By inputting your mortgage balance, interest rate, loan term, and additional payment amounts, this calculator estimates your new payoff date and the total interest savings.

Benefits:

- Shows the impact of extra payments on mortgage payoff

- Helps you save on interest payments over the life of the loan

- Provides motivation and a clear path towards early mortgage payoff

Loan Payoff Calculator Early

The Loan Payoff Calculator Early is designed to help you calculate the benefits of making early or additional payments towards your loans, such as car loans, personal loans, or student loans. By inputting your loan balance, interest rate, loan term, and extra payment amounts, this calculator estimates your new payoff date, interest savings, and the overall reduction in the loan term.

Benefits:

- Demonstrates the advantages of early loan payoff

- Facilitates better financial planning and debt management

- Encourages disciplined repayment habits and financial responsibility

Conclusion

Using a Mortgage Payoff Calculator and Loan Payoff Calculator Early can significantly enhance your ability to make informed decisions about your mortgage and loans. These calculators provide valuable insights into the benefits of early payoff, interest savings, and loan term reduction, empowering you to take control of your financial future. By leveraging these tools and making strategic extra payments, you can accelerate your path to financial freedom and enjoy a life free from the burden of debt. Start using these calculators today to chart your course towards a debt-free future.

FAQ: Mortgage Payoff Calculator

Q1: What is a Mortgage Payoff Calculator or Loan Payoff Calculator?

A1: A Mortgage Payoff Calculator or Loan Payoff Calculator is a financial tool that helps you determine how long it will take to pay off your mortgage or loan in full by making extra payments or paying more than your regular monthly installment.

Q2: How does a Mortgage Payoff Calculator work?

A2: These calculators typically require you to input information such as your current loan balance, interest rate, loan term, and any extra payments you plan to make. They then provide estimates on when you can expect to fully pay off your mortgage or loan.

Q3: What are the benefits of using a Mortgage Payoff Calculator?

A3: Using this calculator allows you to see how making extra payments or increasing your monthly installments can help you pay off your loan sooner and save on interest costs.

Q4: Can I use a Mortgage Payoff Calculator for any type of loan?

A4: While Mortgage Payoff Calculators are specifically designed for mortgages, Loan Payoff Calculators can be used for various types of loans, such as auto loans, personal loans, or student loans.

Q5: Is it worth making extra payments on my mortgage or loan?

A5: Making extra payments can significantly reduce the total interest you pay over the life of your loan and help you become debt-free faster. It’s worth considering if it aligns with your financial goals.

Q6: How often should I use the Mortgage Payoff Calculator?

A6: You can use it as often as you like to explore different scenarios or track your progress in paying off your mortgage or loan.

Q7: Can I include property taxes and insurance in the Mortgage Payoff Calculator?

A7: Some calculators may allow you to factor in property taxes and insurance when estimating your monthly mortgage payment.

Q8: Are the results from a Mortgage Payoff Calculator accurate?

A8: While the calculator provides estimates, actual results may vary based on changes in interest rates, loan terms, and the consistency of extra payments.

Q9: Can I save money by paying off my mortgage or loan early?

A9: Paying off your mortgage or loan early can save you money on interest charges. However, consider your financial situation and goals to determine if it’s the right choice for you.

Q10: Where can I find a Mortgage Payoff Calculator or Loan Payoff Calculator online?

A10: You can find Mortgage Payoff Calculators and Loan Payoff Calculators on financial websites, banking institutions’ websites, and mobile apps. Additionally, you can check out the one provided at https://moderncalculators.com/mortgage-payoff-calculator-loan-payoff-calculator-early/

Mortgage Payoff Calculator – Loan Payoff Calculator Early

Legal Notices and Disclaimer

All Information contained in and produced by the ModernCalculators.com is provided for educational purposes only. This information should not be used for any Financial planning etc. Take the help from Financial experts for any Finace related Topics. This Website will not be responsible for any Financial loss etc.