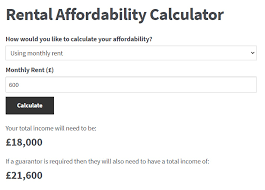

Discover the ultimate solution to finding the perfect rental property within your budget with our Rent Calculator (Rent Calculator Online ). This advanced, user-friendly tool is designed to provide accurate rent estimates, taking the guesswork out of your rental search process. Save time and make well-informed decisions by utilizing our Online Rent Calculator for a seamless and stress-free rental experience.

Determining how much rent you can afford based on your income is a crucial step in finding a suitable rental property. By understanding your financial capabilities, you can avoid overspending on rent and ensure that your housing expenses align with your overall budget. In this comprehensive guide, we will explore various aspects of calculating rent based on income, delve into rent calculator, and discuss how to estimate monthly rental expenses tailored to your earnings. With this in-depth knowledge, you’ll be better prepared to make informed decisions as you navigate the rental market.

[ez-toc]

What is Rent?

Rent is the periodic payment made by a tenant to a landlord in exchange for the use of a residential or commercial property. Rent is typically paid on a monthly basis and serves as the primary source of income for landlords who own rental properties. Rental agreements, or leases, outline the terms and conditions of the rental arrangement, including the duration of the lease, rent amount, payment schedule, and tenant and landlord responsibilities.

What is the Rent-to-Income Ratio or Income-to-Rent Ratio?

The rent-to-income ratio, also known as the income-to-rent ratio, is a financial metric that measures the proportion of a tenant’s gross monthly income allocated to rent payments. This ratio is commonly used by landlords, lenders, and tenants to assess rent affordability and determine whether a rental property is within a tenant’s budget.

To calculate the rent-to-income ratio, divide the monthly rent by the tenant’s gross monthly income. For example, if a tenant earns $4,000 per month and pays $1,200 in rent, their rent-to-income ratio would be 30% ($1,200 / $4,000 = 0.30).

How Much of Your Income Should Go to Rent? – The 30% Rule

A common guideline for rent affordability is the 30% rule, which suggests that you should allocate no more than 30% of your gross monthly income towards rent. This rule provides a basic starting point for determining how much rent you can afford, but it’s essential to consider other factors that may influence your individual circumstances.

For example, if your gross monthly income is $4,000, the 30% rule suggests that you should spend no more than $1,200 on rent ($4,000 x 0.30 = $1,200). However, this rule may not be suitable for everyone, as it does not account for factors such as existing debts, savings goals, or other living expenses.

Things to Consider Before Renting a Property

Before renting a property, consider the following factors to ensure you make an informed decision:

- Affordability: Determine whether the rent is within your budget by calculating your rent-to-income ratio and considering other living expenses.

- Location: Evaluate the property’s location in terms of proximity to work, schools, shopping, and transportation options.

- Amenities and features: Assess the property’s amenities and features, such as appliances, storage space, parking, and outdoor areas.

- Lease terms: Review the lease agreement carefully, paying attention to the duration, rent amount, payment schedule, and tenant and landlord responsibilities.

- Maintenance and repairs: Inquire about the landlord’s maintenance and repair policies, as well as any potential additional costs.

Ways to Reduce Rental Costs

To reduce rental costs, consider the following strategies:

- Negotiate lease terms: Discuss rental rates and terms with your landlord to potentially secure a lower rent or favorable lease conditions.

- Find a roommate: Share living expenses with a roommate to reduce your individual rental costs.

- Choose a less expensive location: Consider renting in a more affordable neighborhood or area with lower rental prices.

- Look for rental incentives: Some landlords offer incentives, such as reduced rent, waived security deposits, or free utilities, to attract tenants.

The Importance of Calculating Rent Based on Income

Calculating rent based on income is essential for several reasons:

Financial stability: Ensuring that your rent is affordable helps maintain financial stability and avoid excessive debt.

Budgeting: Knowing how much rent you can afford enables you to create a realistic budget that includes other living expenses, such as utilities, groceries, and transportation.

Rental market navigation: Understanding your rent affordability range simplifies the process of searching for rental properties and negotiating lease terms with landlords.

Long-term planning: Allocating an appropriate amount of your income towards rent allows you to save and invest in long-term financial goals, such as retirement or homeownership.

Factors to Consider When Estimating Rent Expenses

When determining how much rent you can afford, it’s crucial to consider various factors that may influence your rental budget:

Gross monthly income: Your gross monthly income is your primary source of funds for rent and other expenses. Ensure that your rent does not exceed a reasonable percentage of your income to maintain financial stability.

Debt-to-income ratio: Your debt-to-income ratio is the percentage of your monthly income that goes towards debt payments, such as student loans, credit card debt, or car loans. A high debt-to-income ratio may necessitate a lower rental budget to maintain financial stability.

Savings goals: Consider your short-term and long-term savings goals, such as an emergency fund, retirement savings, or a down payment for a home. Allocate a portion of your income towards these goals and adjust your rental budget accordingly.

Living expenses: Factor in other living expenses, such as utilities, groceries, transportation, insurance, and entertainment, when determining your rental budget. These costs can significantly impact your overall cost.

Location: The cost of living varies widely by location, with urban areas typically being more expensive than rural areas. Consider the cost of living in your desired location and adjust your rental budget accordingly.

Family size: Your family size affects your overall living expenses, as more people typically require a larger living space and higher utility costs. When calculating your rent affordability, consider the needs of your family and the associated expenses.

Creating a Realistic Budget for Rent and Living Expenses

Once you’ve determined how much rent you can afford based on your income, it’s essential to create a realistic budget that accounts for all of your living expenses. To create a comprehensive budget:

List all income sources: Include your salary, freelance income, rental income, or any other sources of income.

Detail your monthly expenses: Itemize your living expenses, such as rent, utilities, groceries, transportation, insurance, and entertainment. Be sure to include debt payments and savings contributions.

Categorize expenses: Organize your expenses into categories, such as housing, transportation, food, and entertainment, to better understand where your money is going.

Compare income and expenses: Compare your total monthly income to your total monthly expenses to ensure that you’re living within your means. If your expenses exceed your income, consider adjusting your budget or exploring ways to increase your income.

Monitor and adjust: Regularly review and update your budget to account for changes in your financial situation, such as increases or decreases in income, new debt, or changes in living expenses. Adjust your budget as needed to maintain financial stability and achieve your financial goals.

Tips for Finding Affordable Rental Properties

Once you’ve determined your rental budget, use these tips to find affordable rental properties that meet your needs:

Research the rental market: Familiarize yourself with the local rental market and average rental prices in your desired area. This knowledge can help you identify good deals and negotiate lease terms with landlords.

Expand your search area: Consider looking in nearby neighborhoods or less popular areas, where rental prices may be more affordable.

Be flexible with your preferences: While it’s important to have a list of must-haves, being open to compromise can help you find more affordable rental options. For example, consider a smaller living space, fewer amenities, or a longer commute.

Look for rental incentives: Some landlords offer incentives, such as reduced rent, waived security deposits, or free utilities, to attract tenants. Keep an eye out for these deals, as they can help reduce your overall housing expenses.

Network with friends and family: Let friends, family, and coworkers know that you’re searching for a rental property, as they may be aware of available units or upcoming vacancies.

Start your search early: Begin your search for a rental property well in advance of your desired move-in date. This gives you ample time to find the best deals and avoid making hasty decisions based on a tight timeline.

Additional Financial Considerations for Renters

When renting a property, it’s important to be aware of additional financial considerations that may impact your overall housing expenses:

Security deposit: Landlords typically require a security deposit equal to one month’s rent. This deposit is refundable at the end of your lease, provided you’ve met the terms of your rental agreement and left the property in good condition.

Renter’s insurance: Renter’s insurance covers your personal belongings and provides liability protection in the event of damage or injury occurring in your rental property. This insurance is relatively affordable and can provide valuable peace of mind.

Application fees and credit checks: Some landlords charge application fees to cover the cost of background and credit checks. These fees can range from $25 to $100 or more, depending on the landlord and location.

Utility costs: Be sure to factor in the cost of utilities, such as electricity, water, gas, and internet, when determining your rental budget. These costs can vary widely based on factors like usage, location, and provider.

Maintenance and repair costs: While landlords are generally responsible for major maintenance and repairs, you may be responsible for minor expenses, such as replacing light bulbs or fixing a leaky faucet.

How Landlords Protect Themselves Against Default in Rent Payment

Landlords use various strategies to protect themselves against default in

rent payment, including:

- Tenant screening: Conducting thorough background and credit checks on potential tenants can help landlords identify those with a history of timely rent payments and responsible financial behavior.

- Security deposit: Landlords typically require a security deposit equal to one month’s rent, which can be used to cover unpaid rent or property damage caused by the tenant.

- Co-signers: In some cases, landlords may require tenants with poor credit or insufficient income to have a co-signer who agrees to be financially responsible for the rent payments if the tenant defaults.

- Renters insurance: Some landlords require tenants to obtain renters insurance, which can provide coverage for lost rent in the event of property damage that renders the unit uninhabitable.

- Late fees: Charging late fees for overdue rent payments can incentivize tenants to pay on time and compensate landlords for the inconvenience of delayed payments.

Final Thoughts

Calculating rent based on income is a critical step in finding an affordable rental property that aligns with your overall financial goals. By using a salary-based rent calculator, considering various factors that impact your rental budget, and creating a realistic budget for rent and living expenses, you can confidently navigate the rental market and find a property that meets your needs. Remember to regularly review and adjust your budget as your financial situation evolves, and consider additional financial factors that may impact your overall housing expenses. With careful planning and consideration, you can find a rental property that supports your financial well-being and helps you achieve your long-term goals.

Online Rent Calculator ( Rent Calculator Online)

Renting a property can be quite a challenge, especially when it comes to determining the right price to pay. In today’s digital age, there are many tools available to help you navigate through this process. One such tool is the online rent calculator. In this article, we will explore the usage and benefits of rent calculators, rent calculator online, and online rent calculator tools, and how they can make your rental experience more manageable.

The Rent Calculator: An Overview

A rent calculator is a handy tool that assists tenants in determining how much rent they can afford based on their income and expenses. This calculator helps you establish a budget and find a suitable property within your price range, preventing financial stress in the long run.

Utilizing a Rent Calculator Online

An online rent calculator is a digital version of the traditional rent calculator. It provides the convenience of calculating your affordable rent from anywhere at any time, with just a few clicks. By entering your income, expenses, and location, the rent calculator online will generate a recommended rental amount that fits your budget.

The Benefits of an Online Rent Calculator

Time-saving: With an online rent calculator, you can quickly and easily determine your rent affordability without the need for manual calculations or guesswork.

Accurate results: Online rent calculators use advanced algorithms to provide accurate results based on your financial situation and current market conditions. This ensures that you find a property within your means, avoiding financial strain in the future.

Customizable options: Online rent calculators allow you to input various expenses, such as utility costs, transportation, and other living expenses, to give you a more accurate representation of your affordable rent.

Location-specific results: Many online rent calculators offer location-based recommendations, taking into account factors such as the cost of living and rental rates in your desired area. This helps you find a property that meets your needs and budget.

Easy comparisons: An online rent calculator enables you to compare various rental properties with ease, helping you make a well-informed decision on your next rental.

Financial planning: By using an online rent calculator, you can effectively plan your budget and ensure you are financially prepared for the rental process.

Conclusion

In conclusion, an online rent calculator is an invaluable tool for anyone looking to rent a property. By using a rent calculator, rent calculator online, or an online rent calculator, you can save time, make informed decisions, and find the perfect rental property within your budget. Don’t waste time guessing your rental affordability – try out an online rent calculator today and make your rental experience stress-free.

Frequently Asked Questions (FAQ)

1. What is rent?

- Rent is the payment made by a tenant to a landlord or property owner in exchange for the use and occupancy of a property. It is typically paid on a regular basis, such as monthly.

2. How is rent calculated?

- Rent is calculated based on various factors, including the property’s location, size, condition, and the local rental market. Landlords often set the rent at a rate they believe tenants are willing to pay.

3. What is an online rent calculator?

- An online rent calculator is a web-based tool or software that helps tenants, landlords, or property managers estimate the appropriate rent for a property. It factors in variables like property details, location, and market conditions to provide a rental price estimate.

4. How do I use a rent calculator online?

- To use an online rent calculator, you typically input information about the property, such as its location, size, and features. The calculator uses this data to estimate a suitable rent amount based on current market conditions.

5. What factors affect the rent amount?

- Several factors can affect the rent amount, including the property’s location, size, condition, amenities, local rental market trends, and demand for rental properties in the area.

6. Is it necessary to use an online rent calculator to determine rent?

- While using an online rent calculator can be helpful, it’s not mandatory. Landlords and tenants can negotiate rent based on market conditions, property features, and individual preferences.

7. How often can a landlord increase the rent?

- The rules for rent increases vary by location and are subject to local rent control laws. In many places, landlords can increase rent once a year with proper notice to tenants.

8. Can a tenant use an online rent calculator to negotiate rent with the landlord?

- Yes, tenants can use online rent calculators as a reference to negotiate rent with landlords. It can provide evidence of a fair market price for the property.

9. Are there any tax implications related to rent payments?

- Rent payments are generally not tax-deductible for tenants, but there may be specific tax benefits for landlords who own rental properties. Consult with a tax professional to understand the tax implications for your situation.

10. What should tenants consider when determining how much rent they can afford?

Tenants should consider their monthly income, other financial obligations, and a reasonable percentage of their income that they can allocate to rent (often recommended to be around 30% of monthly income).

11. Can an online rent calculator predict future rent increases?

No, an online rent calculator can provide estimates based on current market conditions, but it cannot predict future rent increases, which may depend on various factors, including local economic conditions.

12. Is there a standard rental rate for all properties of the same type in a particular area?

There is no standard rental rate for all properties of the same type in an area. Rental rates can vary significantly based on factors like location, property condition, and local market dynamics.

Rent Calculator – Online Rent Calculator – Rent Calculator Online

Legal Notices and Disclaimer

All Information contained in and produced by the ModernCalculators.com is provided for educational purposes only. This information should not be used for any Financial planning etc. Take the help from Financial experts for any Finace related Topics. This Website will not be responsible for any Financial loss etc.